考研英语阅读理解精读:UNIT 13 TXET 3

备考考研的学生应该都有发现,考研阅读的题目基本都围绕在文章的各层次主干上,所以,原文几百字的文章,真正需要理解的主干其实只有几十个字而已,当我们划去冗余,就会发现几十字的文章骨架基本覆盖所有的问题。为了帮助大家更深入的了解,今天,好轻松考研小编给大家带来了考研英语阅读理解精读:UNIT 13 TXET 3,希望能帮助到大家。

TEXT 3

For most of his life Chuck Feeney has guarded his privacy obsessively. When he became a philanthropist, his gifts came on condition that his name never appeared on any press release or plaque; all donations would cease if confidentiality was breached. But when he decided to co-operate with Conor O'Clery on this book, many of the people in his life, released from their Trappist vows, let themselves go. The result is gripping.

An Irish-American, born in New Jersey in 1931, Mr Feeney made a fortune by co-founding Duty Free Shoppers (DFS) which first sold tax-exempt goods to American soldiers abroad and then tapped into the rise of mass tourism. When DFS was sold in 1997, it had delivered nearly $8 billion to its four main shareholders, of which Mr Feeney was the joint biggest, with 38.75% .

Tax avoidance is the flip side to Mr Feeney's philanthropic coin. He is addicted to it. “Chuck hates taxes. He believes people can do more with money than governments can,” says a friend. In 1964 a young New York lawyer, Harvey Dale, told Mr Feeney that changes in the tax laws threatened his business, which was running risks that could put the founders in jail. On his advice, Mr Feeney and his co-founder, Robert Miller, transferred ownership to their foreign-born wives, from France and Ecuador, respectively. In 1974, through a deal with the American government, the firm turned the Pacific island of Saipan into a tax haven. Then, in 1978, Mr Feeney grouped his various investments, including his shares of DFS, in a holding company, General Atlantic Group Limited, in tax-free Bermuda. To escape the American taxman, everything was still registered in his wife's name.

Mr Feeney carefully shunned all outward evidence of wealth. But as soon as DFS became reliably profitable, he started the practice of giving 5% of his pre-tax profits to good causes. In 1982 he created a foundation, the Atlantic Philanthropies, based in Bermuda. Two years later he signed over his fortune to the foundation, except for sums set aside for his wife and children. His net worth fell below $5m. When he broke the news to his children, he gave them each a copy of Andrew Carnegie's essay on wealth, written in 1889.

Mr Feeney has given his alma mater, Cornell University, more than $600m, dwarfing all other donations from a single alumnus to an American university. He has contributed hundreds of millions of dollars towards higher education in Ireland, South Africa and Australia. He has helped with health care in Vietnam. In 2004 he went to Cuba, where he met Fidel Castro, who seemed only too happy to accept his capitalist-tax-avoided dollars. But it was his support for the Irish peace process that caused the most controversy, including accusations (without foundation, it turned out) that he had financed the IRA.

Mr Feeney is committed to giving away all the money in his foundation by a fixed date—thought to be in about ten years—but his investment prowess makes this difficult. Currently, Atlantic Philanthropies is worth $4 billion (up from $3.5 billion in 2001) even though, over its lifetime, it has given away about $4 billion in increasing amounts. The trouble for Mr Feeney is that the foundation's assets are growing as fast as he tries to get rid of them.

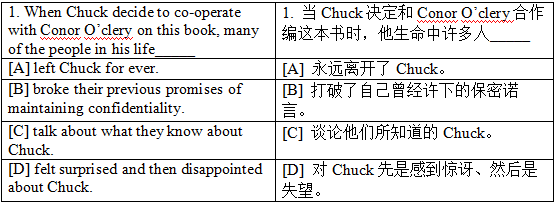

1. When Chuck decide to co-operate with Conor O’clery on this book, many of the people in his life_____

[A] left Chuck for ever.

[B] broke previous their promises of maintaining confidentiality.

[C] talk about what they know about Chuck.

[D] felt surprised and then disappointed about Chuck.

2. Mr Feeney was dedicated to avoiding tax because_____

[A] he wanted to make more money.

[B] he wanted to give more money to good causes.

[C] he thought the government was corrupted.

[D] he thought people could manage the society with their own money by themselves.

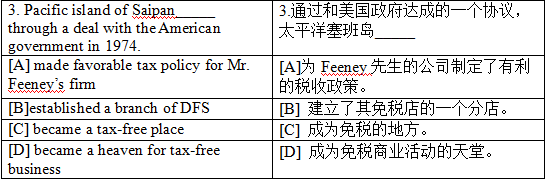

3. Pacific island of Saipan _____ through a deal with the American government in 1974.

[A] made favorable tax policy for Mr. Feeney’s firm

[B] established a branch of DFS.

[C] became a tax-free place

[D] became a heaven for tax-free business

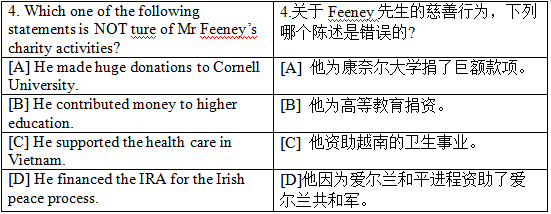

4. Which one of the following statements is NOT true of Mr. Feeney’s charity activities?

[A] He made huge donations to Cornell University.

[B] He contributed money to higher education.

[C] He supported the health care in Vietnam.

[D] He financed the IRA for the Irish peace process

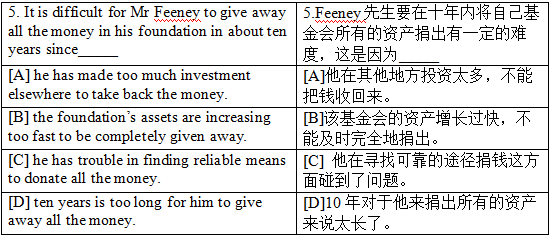

5. It is difficult for Mr. Feeney to give away all the money in his foundation in about ten years since_____

[A] he has made too much investment elsewhere to take back the money.

[B] the foundation’s assets are increasing too fast to be completely given away.

[C] he has trouble in finding reliable means to donate all the money.

[D] ten years is too long for him to give away all the money.

文章剖析:

这篇文章介绍了一位慈善家Chuck Feeney。段讲述Feeney先生不愿意透露自己的隐私,却最后答应合作编这本书让自己的秘密公众于天下;第二段讲述Feeney先生的身世和创业;第三段讲述Feeney先生对免税事业的执著;第四段讲述他成立了基金会;第五段讲述其基金会的捐赠历史;第六段讲述他完成捐款任务的困难。

词汇注释:

Philanthropist n. 慈善家phaque n. 匾额

Trappist n. n.[宗](天主教西多会中的)特拉普派(的)(此派强调缄口苦修)

gripping adj. 引起人注意的;吸引人的

alma master n. 母校proess n. 威力

难句突破:

(1)Then, in 1978, Mr Feeney grouped his various investments, including his shares of DFS, in a holding company, General Atlantic Group Limited, in tax-free Bermuda.

[主体句式] Mr Feeney grouped his investments in a holding company in tax-free Bermuda.

[结构分析]这是一个简单句,including…现在分词结构是前面investments的定语;General Atlantic Group Limited是前面company的同位语。

[句子译文] 1978年,Feeney先生把自己各种投资都集合起来,包括他在免税店的份额,然后投进了一家在免税的百慕大群岛成立控股公司——大西洋有限公司。

(2) Currently, Atlantic Philanthropies is worth $4 billion (up from $3.5 billion in 2001) even though, over its lifetime, it has given away about $4 billion in increasing amounts.

[主体句式] Atlantic Philanthropies is worth… even though it has given…

[结构分析] 这是一个复合句。后面分句中,over its lifetime是分句的状语。

[句子译文] 目前“大西洋慈善”价值40亿美元(而在2001年只有35亿)这是在已经累计捐出了40亿美元之后的情况。

[答案]C

[难度系数] ☆☆☆

[分析]推理题。段提到Chuck一直在保护自己的隐私,但提到合作写这本书时用了转折词,可以推断这次他并没有缄口,他生命中的许多人也因此可以随意谈论他们所知道的Chunk。选项中C符合题意。A和D选项是明显错误的,而B选项是一个较强的干扰选项。错误在于这些人不是打破了自己的诺言,而是现在已经没有必要再遵守诺言了,因此连Chunk自己都已经开金口了。

[答案]D

[难度系数] ☆☆☆☆

[分析]细节题。第三段提到,Feeney先生对免税上了瘾,因为他认为人们用钱可以比政府办更多的事情,因此,选项中D最为符合题意。C作者并未提到政府腐败,只是提到人们用钱可以比政府办的事情更多。

[答案]C

[难度系数] ☆☆☆☆

[分析]推理题。文章第三段提到,Feeney先生为了避免法律麻烦,把免税店转给了妻子,而后来同美国政府达成协议,把塞班岛成为了一个“水手避难所”,也就是免税的地方。C选项为正确答案。A选项是错误的,因为塞班岛是同美国政府达成的协议,并没有专门为Feeney先生的公司制定政策。B选项显然是错误的,因为不仅仅是开一个免税店的问题那么简单,而是整个岛都变成了免税的地方。D选项有一定的干扰性,虽然小岛上都是免税的,但是没有证据表明它成为了免税商业活动的天堂。

[答案]D

[难度系数] ☆☆☆

[分析]细节题。选项A、B、C在文章第五段中都可以找出来,“Feeney先生捐给自己的母校康奈尔大学6亿多美元,数额超过了美国大学所有毕业生单独捐款的数额。他还捐献了几亿美元用于爱尔兰、南非和澳大利亚的高等教育。他还资助了越南的卫生保健。2004年他到了古巴,在那里会见了菲德尔·卡斯特罗,虽然卡斯特罗太高兴了,却不愿意接受资本家免税得来的美元”。D选项,他援助了爱尔兰和平进程,但是文章指出他资助了爱尔兰共和军是没有根据的。因此,D为正确答案。

[答案] B

[难度系数] ☆☆☆

[分析]细节题。文章最后一段提到他的投资能力不断增加,基金会资产不断增加,所以要把钱全部捐出去还是个困难。因此选项B是符合这个意思的。其他三个选项都与文章内容无关,属于无中生有。

参考译文:

Chuck Feeney在生命的大部分时间里都竭尽全力保护自己的私人生活不受干扰。成为一个慈善家后,他在捐赠时提出的条件就是自己的名字不能出现在任何新闻稿或匾额上。如果违反了这种机密性,他的捐赠就会中止。但是当他决定要和Conor O’clery合作写本书时,他生命中的许多人都得以摆脱他们缄口的誓言,从而可以畅所欲言了。这个结果真是够吸引人的。

Feeney先生是一位美籍爱尔兰人,1931年出生在新泽西。他和别人共同创办了免税店而发了大财,该免税店最开始是向那些在国外的美国士兵出售免税商品。后来随着旅游者的增多,业务也转向了他们。1997年卖掉免税店时,四个大股东得到了80亿美元,而Feeney是的股东,他占有的份额为38.75%。

免税只是Feeney先生慈善事业的另一面而已。他甚至对免税上了瘾。“Chuck憎恨税收。他认为人们用钱可以比政府办更多的事情。” 他的一位朋友说。1964年,一位年轻的纽约律师Harvey Dale告诉Feeney先生税收法的改革可能会威胁到他的生意,甚至可能会让这些创办者们锒铛入狱。在他的建议下,Feeney和他的合伙人Robert Miller将免税店所有权移交给了他们分别出生在法国和厄瓜多尔的妻子。1974年,通过与美国政府的一项协议,公司将太平洋上的塞班岛变成了一个免税的地方。1978年,Feeney先生把自己各种投资都集合起来,包括他在免税店的份额,然后投进了一家在免税的百慕大群岛成立控股公司——大西洋有限公司。为了逃避美国的收税员,所有公司都是以他妻子的名义注册的。

Feeney先生小心地抹去了自己财产的所有表面证据。但是当他确定免税店已经盈利的时候,他开始将自己税前利润的5%用于慈善事业。1982年他创立了一个基金会——大西洋慈善事业,总部设在百慕大。两年后他将自己的财产转到该基金会,只留了一些给妻子和孩子。他的净资产从而降到了500万美元以下。当他告诉孩子们这个消息时,他给每个孩子都送上了一篇卡内基1889年写的关于财富的文章。

Feeney先生捐给自己的母校康奈尔大学的资助达6亿多美元,数额超过了美国大学所有毕业生单独捐款的数额。他还捐了几亿美元用于爱尔兰、南非和澳大利亚的高等教育。此外他也资助了越南的卫生保健事业。2004年他来到古巴,在那里会见了Fidel Castro,Castro非常高兴地接受了Feeney先生通过免税得来的美元。但是正是他对爱尔兰和平运动的援助,才导致了的争议,人们指责他赞助了爱尔兰共和军(事实上毫无根据)

Fenney先生在某一固定日期之前会把所有的财产投入其基金会(可能10年),但是他的投资能力却为这项任务增加了困难。目前“大西洋慈善”价值40亿美元(而在2001年只有35亿)这是在已经累计捐出了40亿美元之后的情况。Feeney目前面临的问题是基金会财产增长的速度和他捐钱的速度几乎是齐头并进的。

考试马上就要来临,为了拿稳考研阅读的分值,大家一定要努力刷题,正确刷题哦。以上就是好轻松考研小编对于考研英语阅读理解精读:UNIT 13 TXET 3内容的整理,希望对大家有帮助哦。

免费领取资料

独家考研团队题型预测,考研英语近20年真题解析+高分范文,政治复习资料全集、最新政治热点,数学常考公式以及专业课等资料

方法1:扫码添辅导老师微信

微信号:xhdkaoyan

方法2:填写个人信息老师亲自联系您

-

考研英语历年真题

获取扫码添加老师微信

请注明:姓名-公司-职位

以便审核进群资格,未注明

则拒绝 -

考研数学历年真题

获取扫码添加老师微信

请注明:姓名-公司-职位

以便审核进群资格,未注明

则拒绝 -

考研政治各科历年真题

获取扫码添加老师微信

请注明:姓名-公司-职位

以便审核进群资格,未注明

则拒绝 -

专业课历年真题

获取扫码添加老师微信

请注明:姓名-公司-职位

以便审核进群资格,未注明

则拒绝 -

课程录播(视频)

获取扫码添加老师微信

请注明:姓名-公司-职位

以便审核进群资格,未注明

则拒绝